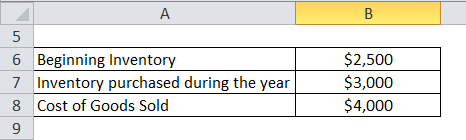

Multiply the ending inventory (also known as closing inventory) balance by the production cost of each inventory item. Note: COGS = (Previous period’s beginning inventory + previous period’s purchases) – previous period’s ending inventoryĢ. Determine the cost of goods sold (COGS) based on your previous period’s accounting records.

#Formula of closing inventory how to#

To help you understand how to find the beginning inventory, let’s break down the necessary steps:ġ. How to Calculate Beginning Inventory?Ĭalculating beginning inventory is a straightforward process using the following formula: Beginning inventory = Cost of goods sold + Ending inventory – Purchases Beginning inventory is categorized as a current asset and is important in inventory accounting. This valuation encompasses all the goods a business possesses and can utilize to generate revenue. What is a Beginning Inventory?īeginning Inventory, also known as opening inventory, refers to the book value of a company’s inventory at the commencement of an accounting period. You can learn more about starting inventory, the application of the formula, and its implications for your business’s financial status in this article.

Consequently, it is crucial to compute starting inventory and comprehend its significance for your business’s well-being. Beginning inventory is a measure that aids in assessing demand, monitoring inventory management, and preparing for tax deductions.

0 kommentar(er)

0 kommentar(er)